Cash Receipt

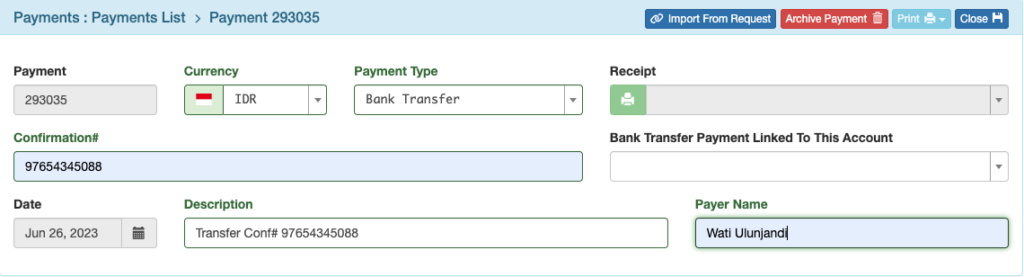

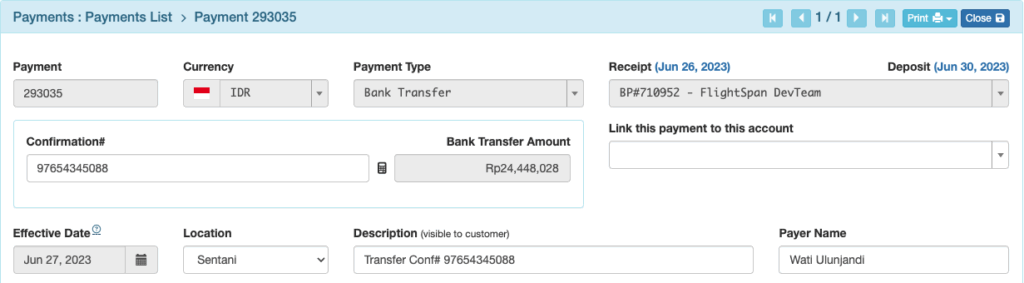

Cash and other company authorized forms of payment such as credit card or bank transfer are all treated like a cash receipt. For traceability the credit card or bank transfer transaction number should be put in the description.

A cash-type payment from an account holder can be linked to their account so it will show up on their statement.

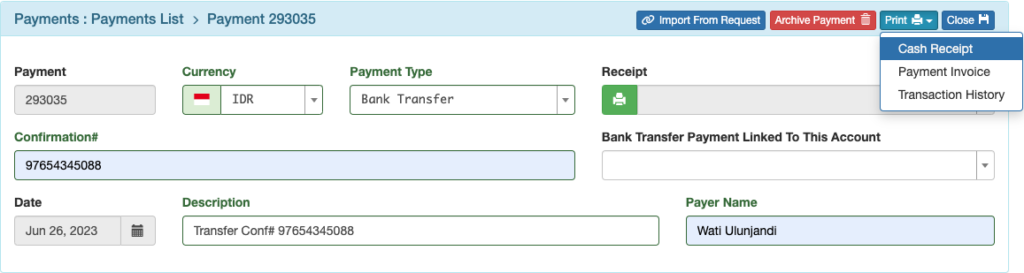

For all cash-type payment methods (any type of payment other than Charge Account), print a Cash Receipt using either the Green receipt button or the blue Print button at the top to indicate payment was received. Printing a receipt also activates the payment and makes it possible to link to a flight. (Payments with a Charge Account as the payment method are always active.)

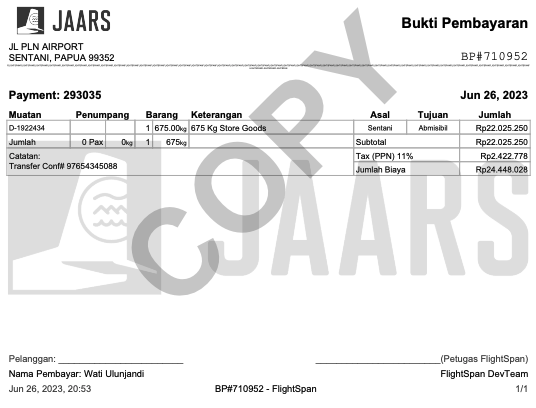

Two copies of the receipt will be printed, one for the customer and one for the deposit record. Reprints of the same receipt will have a “Copy” watermark added.

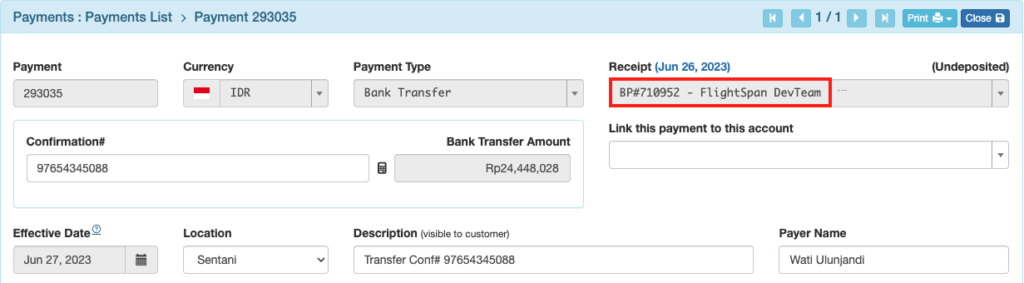

A receipt number is automatically generated when the receipt is printed.

Just above the receipt number is the receipt date, which is also a link to the Receipt Series page.

Once the cash has been deposited, the deposit date is added, which is also a link to the Deposit record.

Note: In some operations, the person documenting the payment and the load is different from the individual accepting the payment. If that is the case, staff roles can be set so that the person accepting the payment is the one who can print the receipt.

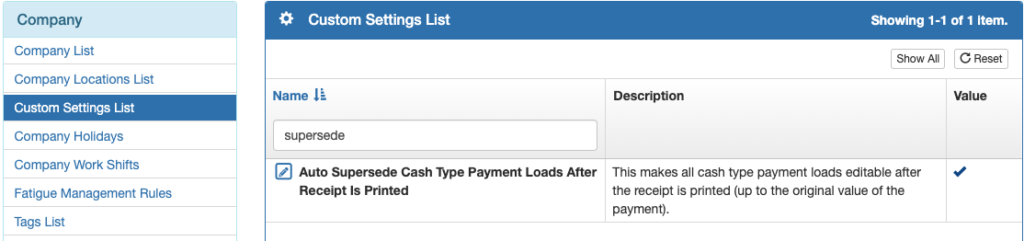

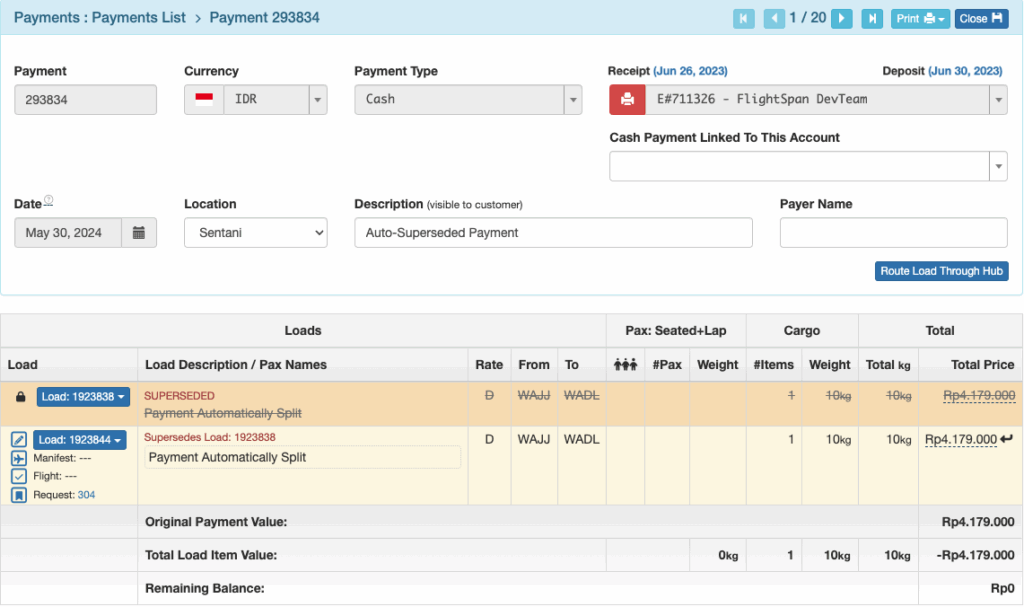

If the company custom setting is enabled, Cash type payments will be automatically split so they can be easily edited from the schedule detail.

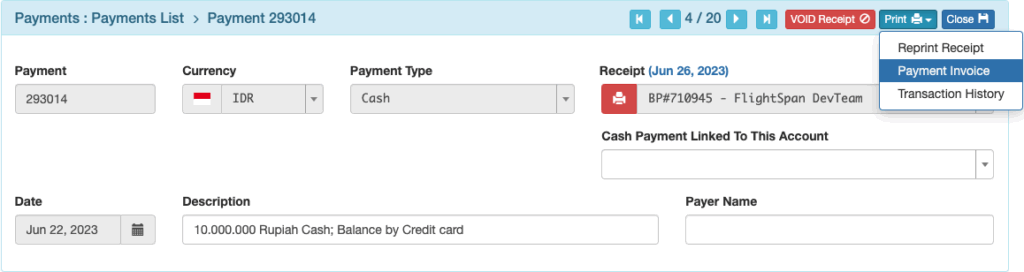

Payment Invoice

A Payment Invoice can be either printed or saved as a PDF for cash and non-cash transactions. From the Print menu click Payment Invoice.

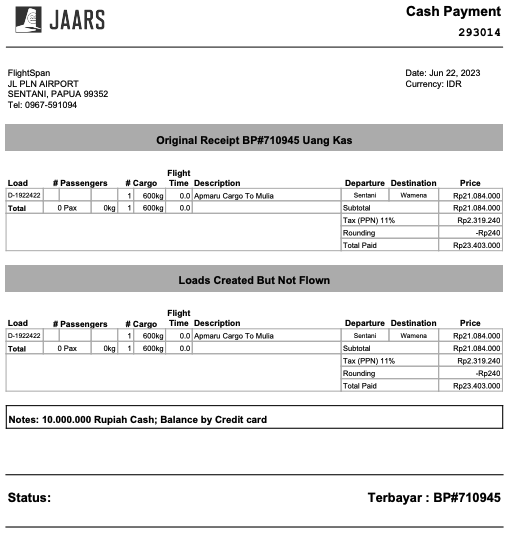

Cash-type invoices will be labeled with Cash Payment and will reflect all loads associated with the payment, flown or not flown.

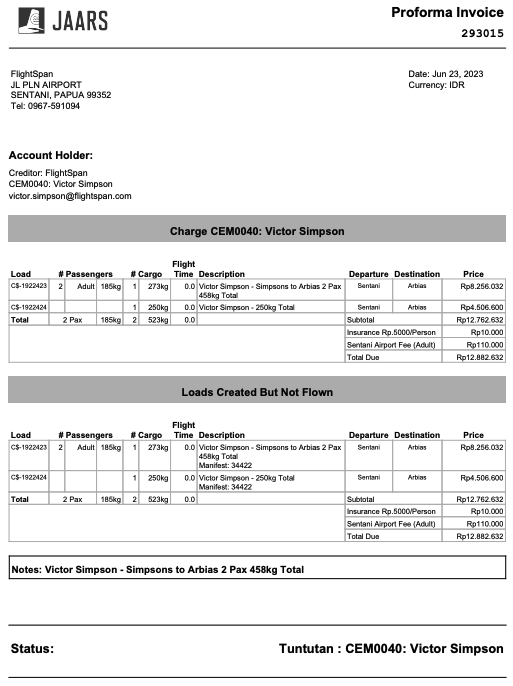

If a payment is not yet flown, invoices linked to an account will be labeled Proforma Invoice.

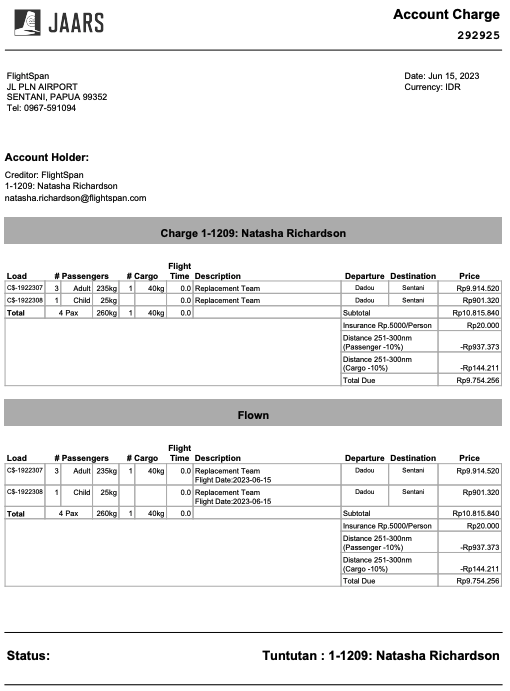

Once a load associated with an account has been flown, the invoice will be labeled Account Charge.

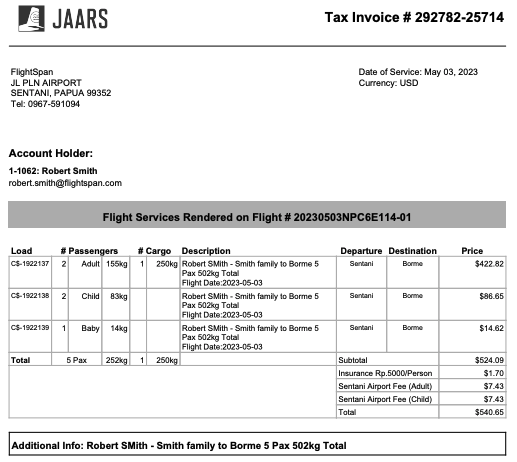

Tax Invoice

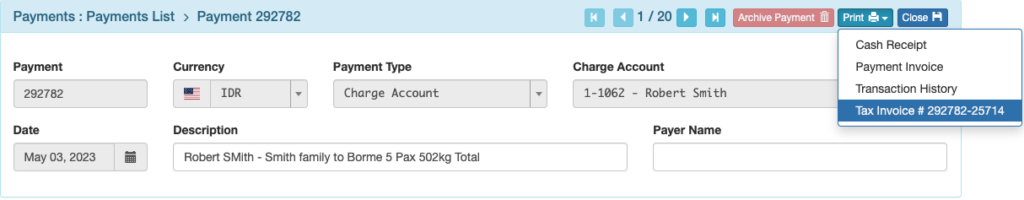

Once a payment associated with a charge account has been fully exported and the flight locked, an additional print option will appear.

The Tax Invoice can be printed or saved as a PDF, and is a simplified display of the transaction and services provided, with taxes and fees separated from services. It is often used in situations where tax refunds may be possible.

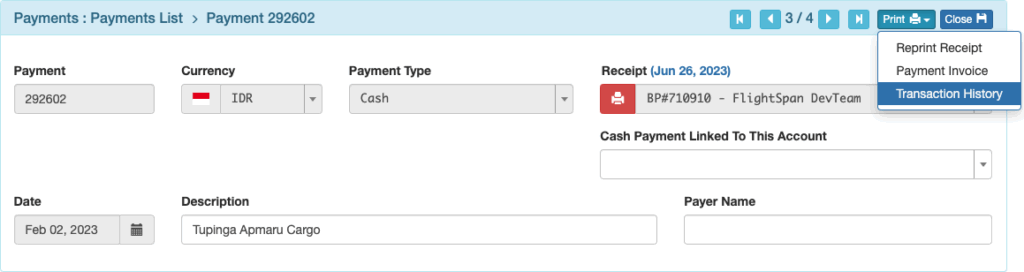

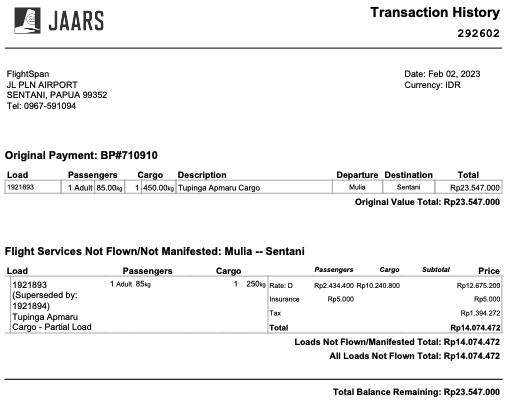

Transaction History

The Transaction History can be either printed or saved as a PDF for cash and non-cash transactions. From the Print menu on the Payment Record, click Transaction History.

Transaction History shows the full history of the transaction and is useful when parts of a payment are flown on different dates, different flights or when part of a payment has been refunded.

Video Version