Price Line Items are used for taxes, insurance, discounts, and surcharges. They will be displayed as line items on any table summarizing the price, such as a receipt or invoice.

Click on Price Line Items under the Rate Adjustments Lists menu on the left. Edit by clicking on the name in the Title column, or create a new category with the green New button.

There are four Types of Price Line Items to choose from.

There are three Rate Adjustment Factors to choose from. Pax_price will calculate the result from the passenger price, cgo_price will calculate the result from the cargo price and ttl_price will calculate the result from the total price.

And there are five calculation methods to choose from. Selected Field refers to the Rate selected in the previous step.

Finally, set the Adjustment Amount in the chosen currency, then the Rounding Precision and Adjustment Criteria to get the desired result, and save.

The following Adjustment Criteria are used only to determine when a Price Line Item will be applied. If none of these Adjustment Criteria are selected, the Price Line Item will be applied for all departure points, destinations, passenger types, and cargo types:

- For Departure

- For Destination

- For Passenger Type

- For Cargo Type

When the selected calculation method is either Set From Factor or Adjust By Factor, at least one of the following Adjustment Criteria values are required and are used as variables in the formula. The other calculation methods do not use these Adjustment Criteria values as calculation variables.

- For Distance

- For Passenger Count

- For Passenger Weight

- For Cargo Count

- For Cargo Weight

- For Total Weight

Scroll down and use the blue plus button to add the Price Line Item to each of the rates that will use it.

You can Select all or search for and link rates individually.

Note: Effective Date will default to tomorrow. Use the blue pencil icon if necessary to change the effective date, and set an expiration date if necessary.

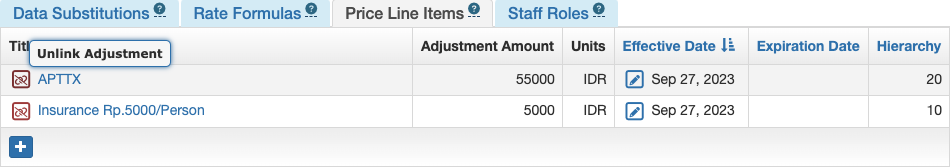

Once you have created all your Price Line Items and linked them to Rates, open a Rate that uses all of the Price Line Items. Use the blue pencil icon by the date to change the effective date or add an expiration date, and to set the Hierarchy as required.

Hierarchy determines the order of calculation. Higher numbers are calculated first, lower numbers are calculated last. Two separate calculations cannot have the same hierarchy.

Price Line Items can also be linked to a Rate from the Rate itself. From the Rate’s Price Line Items tab click the blue plus button to add Price Line Items.

Unlink Price Line Items using the red Unlink icons.

Note: Once a Price Line Item has been used with a Rate, it can no longer be unlinked from the Rate. Instead, set an expiration date so it can no longer be used.

Video Version