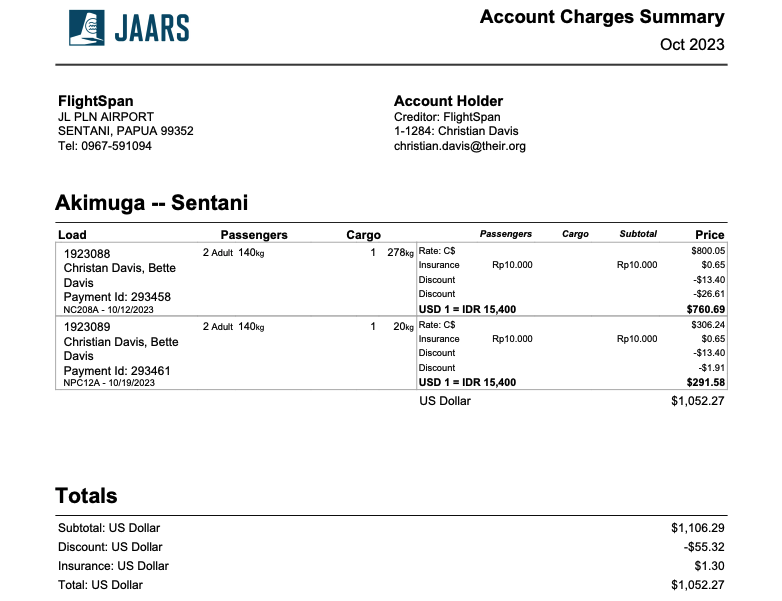

FlightSpan Ops allows you to send email statements of accounts and tax invoices to account holders who have email addresses registered with their accounts. For account holders who do not have email addresses, or for cash-type payments, the same statements may be printed for distribution.

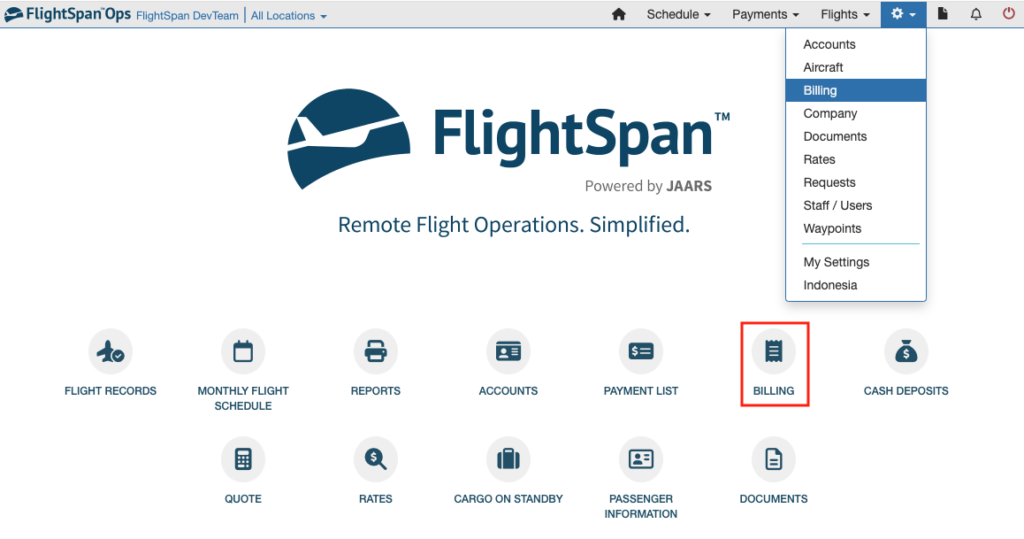

Open Billing from the Home page if you have added the shortcut, or from any page select Billing from the Settings menu.

Email Documents

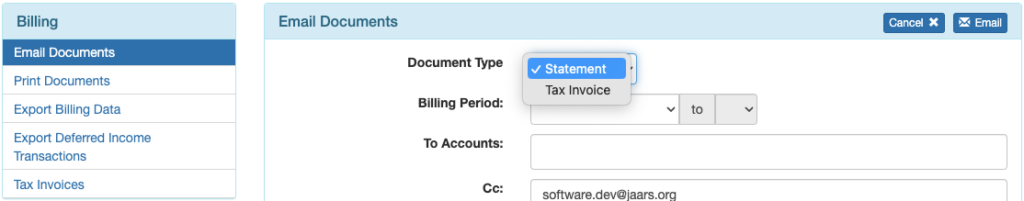

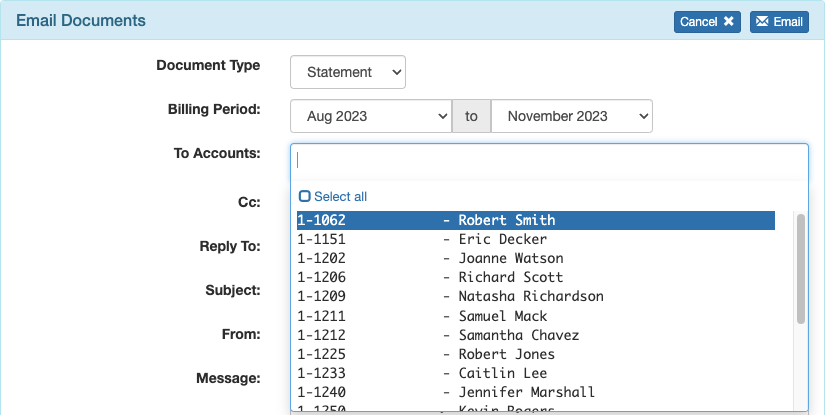

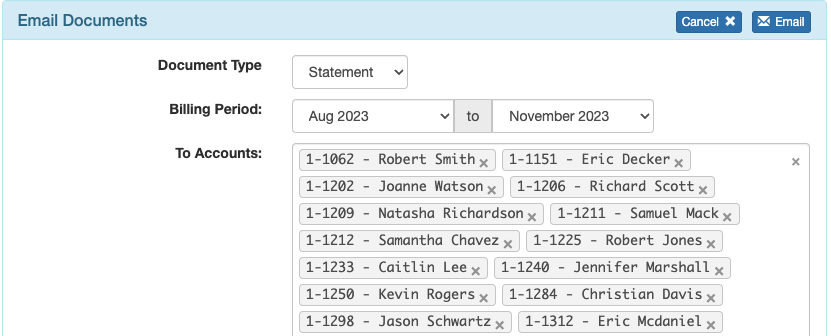

Select Email Documents from the Billing Menu and select the type of document. If you select Tax Invoices, you may find the method described below easier.

From here, statements and tax invoices can only be sent to account holders.

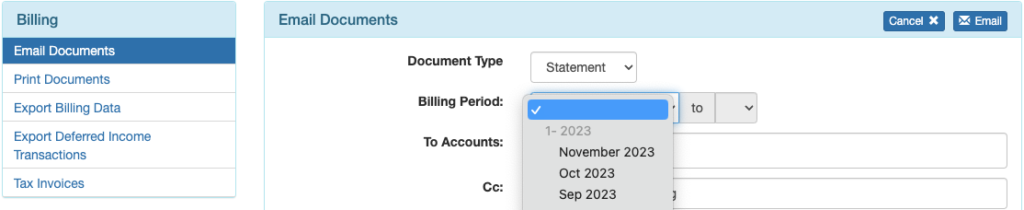

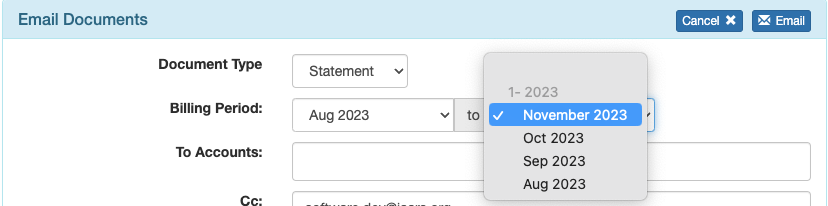

Select the desired billing period.

Multiple billing periods may be selected.

Only accounts with valid/active email addresses and having activity during the selected billing period will be displayed.

Select individual accounts or Select All.

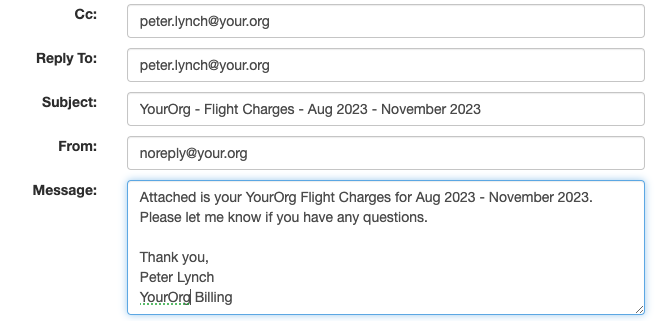

The cc: and Reply To: email addresses are set based on the user who is logged in; company name and date in the Subject line are automatically filled in, as is the date in the body of the email. The message content is standard, and the name under the signature (‘Thank you,’) is also set based on the user who is logged in. In the example below, the user Peter Lynch is logged into YourOrg.

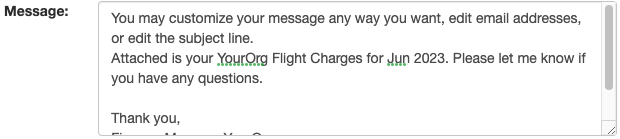

If desired you may manually edit any of the data or addresses before sending.

Print Documents

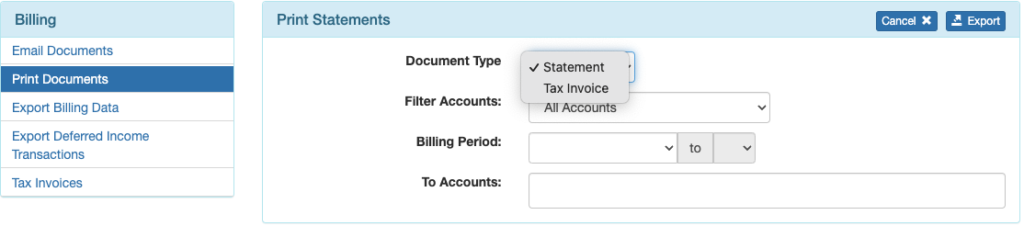

Select Print documents from the Billing menu and select the document type. Again, if you select Tax Invoices, you may find the method described below easier.

From here, statements and tax invoices can only be printed for account holders.

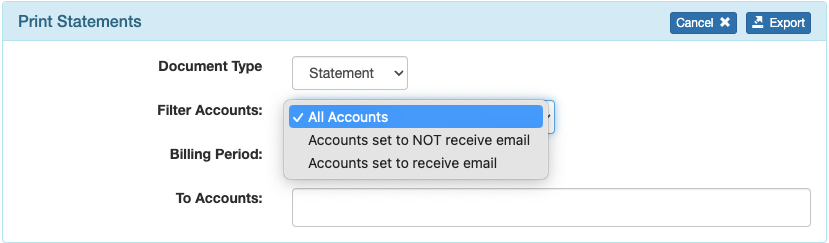

Filter accounts as desired.

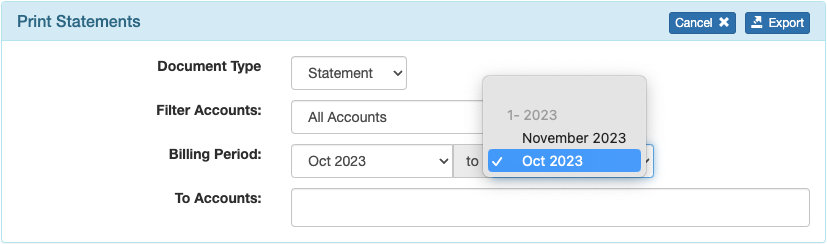

Select the desired billing period or periods.

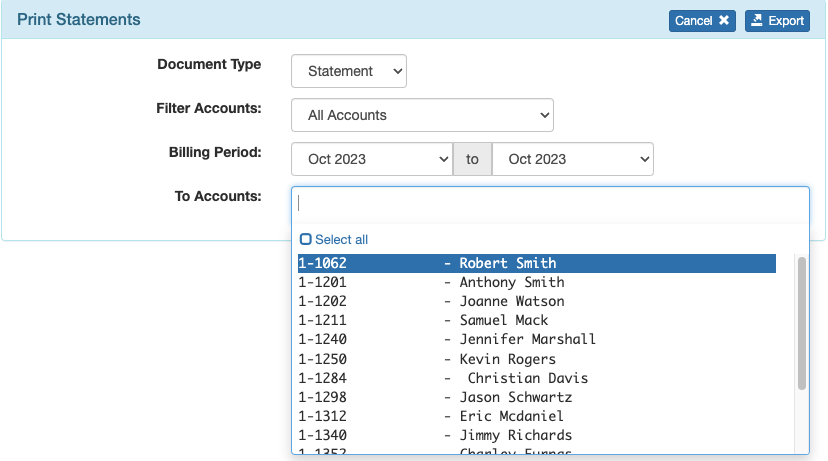

Only accounts with activity within the filter set and date range are displayed. Select all or individual accounts and Export to a printed file.

Each account receives its own printed copy.

Export Billing Data

FlightSpan™ Ops allows you to export your billing data to your organization’s financial software package. The export file format can be customized by the FlightSpan™ team for that software.

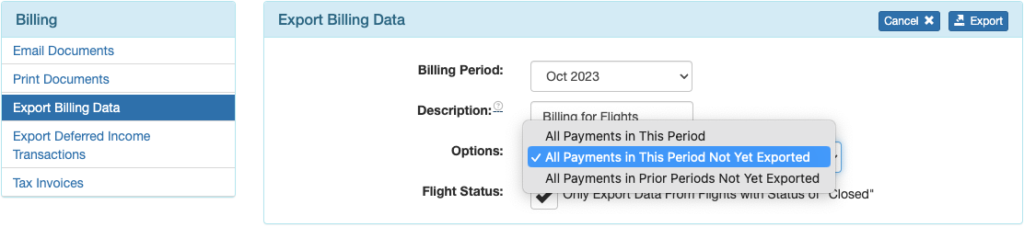

Select Export Billing Data from the Billing menu, select billing month, and which set of statements to export. If the Flight Status box is checked, only flights that have been marked closed on the Flight Record will be exported.

Flights with a Closed status:

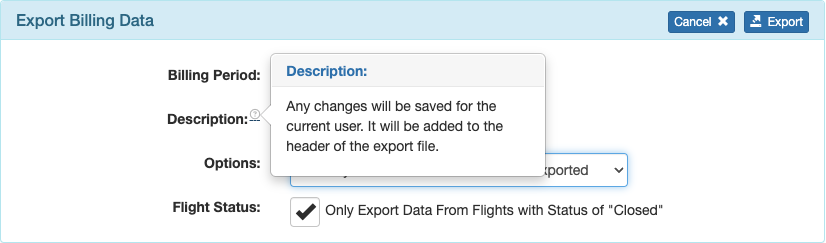

Each user can customize the description that will appear in the header of the export file.

Data will be exported to a .csv file compatible with your finance software.

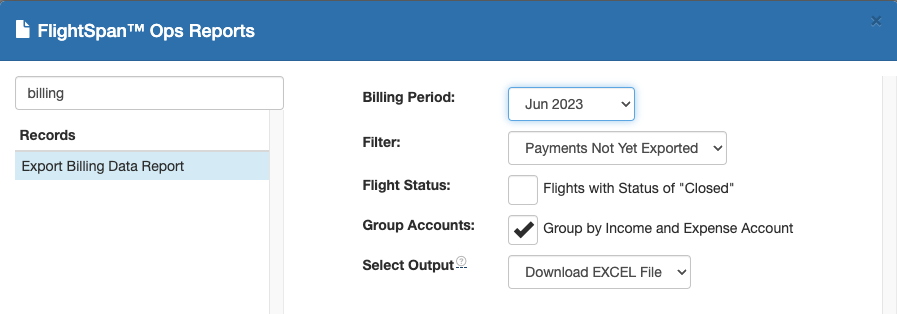

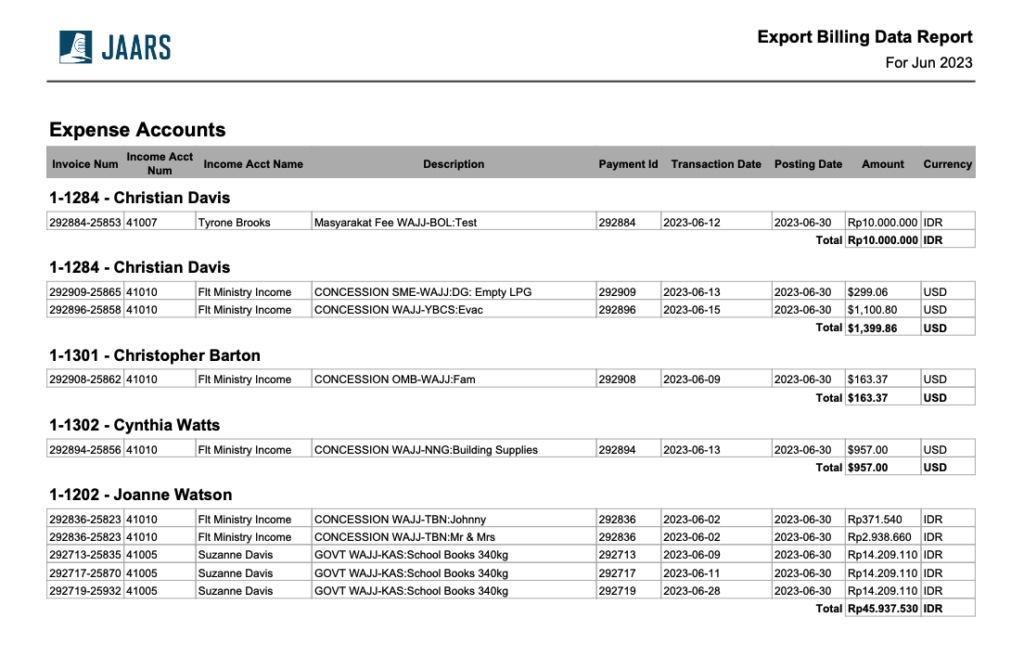

A readable version of the export file is also available with the Export Billing Data Report in the reports section.

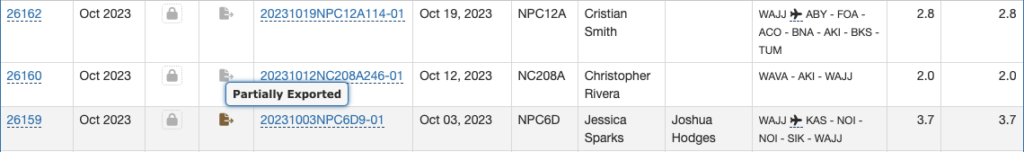

The red Not Exported icon will change to a gray Exported icon on the Flight Records page. Once a record has been exported, the billing data can no longer be edited.

If a record is partially exported, it is because a payment with multiple loads is associated with the flight, and one or more of the loads is still unflown.

Tax Invoices

Select Tax Invoices to print or email tax invoices for account holders and print tax invoices for cash payments. Note that Tax Invoices become available only after the Payment has been flown on a flight and that flight’s status has been set to Closed (indicating the loading on the flight has been checked and confirmed).

The tax invoice number consists of the Payment Number followed by the Flight Number. Click on the numbers to view their respective details.

Search, sort, reset, and show all as with other lists.

Select all invoices on the page with the upper checkbox, or select the desired individual records using their respective check boxes.

If you click Email Selected, the Email Documents window will open with the selected document(s) prefilled. Edit the email as desired, then click Email.

If there is no email address associated with an invoice, it will be flagged.

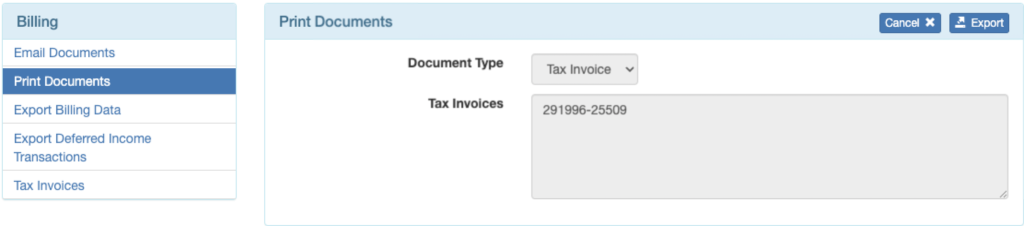

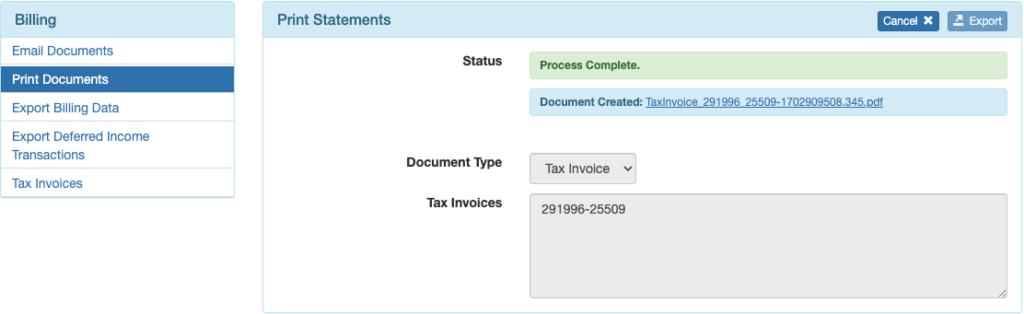

If you click Print Selected, the Print Documents window will open momentarily with the selected document(s) prefilled, then will immediately export the document(s) for printing.

The Print Documents window will display a status report.

Video Version